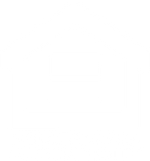

BIDDING WAR TO COME?

If you’re wondering how it’s due to 2 in 3 homebuyers waiting for rates to fall before they buy a home.

Our team is here to help you avoid a potential future bidding war by helping you purchase the home of your dreams now. With a no pre-payment loan you can refinance when rates drop without paying a penalty.

Reach out to learn what programs could help you get into the home of your dreams.

More Mortgage Options For Your Unique Financing Needs

call us

561-698-2040

ABOUT US

Our team of loan officers boasts an impressive 20 years of combined experience, having successfully closed thousands of loans across countless scenarios.

With a presence on both the East and West coasts, we're primed to provide extended operating hours, ensuring we're always available to meet your needs.

Our unparalleled expertise and deep industry knowledge set us apart, making us your go-to for smart, reliable, and timely lending solutions. Trust in our experience to guide you smoothly through every step of the lending journey.

MORTGAGE PROGRAMS

Fixed Rate

The most common type of loan option, the traditional fixed-rate mortgage includes monthly principal and interest payments which never change during the loan’s lifetime.

Adjustable ARM

Interest Only

Adjustable-rate mortgages include interest payments which shift during the loan’s term, depending on current market conditions.

Interest only mortgages are home loans in which borrowers make monthly payments solely toward the interest accruing on the loan, rather than the principle, for a specified period.

Graduated Payments

Graduated Payment Mortgages are loans in which mortgage payments increase annually for a predetermined period of time (e.g. five or ten years) then becomes fixed for the remaining duration of the loan.

FHA Home Loan

FHA home loans are mortgages which are insured by the Federal Housing Administration (FHA), allowing borrowers to get competitive mortgage rates with a minimal down payment.

VA Loans

VA loans are mortgages guaranteed by the Department of Veteran Affairs. These loans offer military veterans exceptional benefits, including competitive interest rates and no down payment options.

USDA Loans

If you're looking to buy a home in a rural or suburban area with no down payment and minimal investment, you might consider the USDA Rural Development Loan.

Jumbo Loans

A jumbo loan is a mortgage used to finance properties that are too expensive for a conventional conforming loan. The maximum amount for a conforming loan is $548,250 in most counties, as determined by the Federal Housing Finance Agency (FHFA).

More Mortgage Options For Your Unique Financing Needs

call us

561-698-2040

OUR IMPACT

Thousands

Mortgage loans closed

Never Enough

Clients served

Too Many

Cups of coffee

Incalculable

Amount we've saved clients

HOMEBUYER TIPS

How to Improve and Fix Your Credit Score ASAP, Qualify For a Lower Interest Rate and Buy Your Home!

Here's 3 simple tips to Improve and Fix Your Credit Score ASAP without hiring a credit repair company! 😊 Yes, you can do it on your own. 🙌 For many of us 2020 left us with a lot of credit card debt, which brings your credit score down, but don't worry there's hope.

Your credit score relies on multiple factors, but one of the big factors is credit utilization. That might sound confusing, but all it means is how much of your credit are you using. An example would be if one of your credit card limits is $1,000 and you have a $300 balance, your credit utilization would be 30%.

QUICK TIP: 30% is the magic number that you want to keep your credit utilization below. If your credit card balances are above 30% of your credit card limit, don't worry I explain what you can do in this short video.

Click the YouTube button below to watch our quick video.

TEAM LEADERS

Sean Wigand

Mortgage Loan Officer

NMLS # 1715261

Sean brings over two decades of real estate and mortgage experience. He has built multiple businesses in various industries and excels in marketing.

Ryan Leach

Senior Mortgage Loan Officer

NMLS # 181289

Ryan brings over two decades of real estate and mortgage experience. Ryan has closed thousands of loans and is an expert in finance, loan programs, and taxes.

GET IN TOUCH

Loan Officers

Sean Wigand

NMLS # 1715261

(561) 698-2040

seanw@barrettfinancial.com

Ryan Leach

NMLS # 181289

(949) 652-6194

ryan@barrettfinancial.com

Corporate Office

Barrett Financial Group, Inc.

275 E Rivulon Blvd, Suite 200,

Gilbert, AZ 85297

Company NMLS # 181106